Checking solutions, not obstacles.

Need a fresh start? Enjoy quality account services with MyOpportunity Checking, even if you've had trouble with your checking account in the past.

- Free VISA Debit Card

- Access to 85,000+ free nationwide ATMs

- Free Digital Banking with bill pay and alerts

- Free eStatements with check images

- Free 24-hour phone banking

- Free Overdraft Protection from Personal Savings

- Low monthly service charge of $10.95

- $25 minimum deposit to open account

- Free VISA Debit Card

- Access to 85,000+ free nationwide ATMs

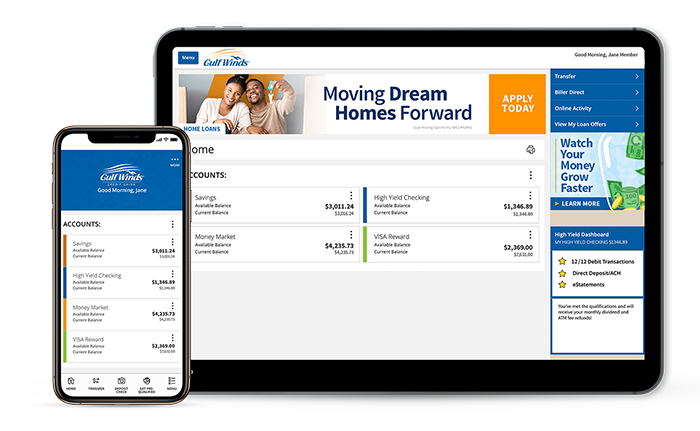

- Free Digital Banking with bill pay and alerts

- Free eStatements with check images

- Free 24-hour phone banking

- Free Overdraft Protection from Personal Savings

- Low monthly service charge of $10.95

- $25 minimum deposit to open account

Gulf Winds helped me get back and track and gave me a chance when other Financial Institutions wouldn't.Joe W.

Open Your Account Today

You focus on the future. We'll handle the rest.

Account opening subject to approval. Account cannot be opened online.

Additional Checking Options

Account opening subject to approval.

1Subject to account qualification after 30 days. A fee will be incurred for use of this service.

**Early access to direct deposit funds depends on the timing of the submission of the payment file from the payer. We generally make these funds available on the day the payment file is received, which may be up to 2 days earlier than the scheduled payment date.