Six Ways to Save on Auto Insurance

If you drive a vehicle, having car insurance is a must. Car insurance not only helps cover the cost of vehicle damages in the event of an accident, it also helps pay medical bills if the other party is injured. While car insurance can be pricey, it doesn’t necessarily have to be. Here are a few tips on how to save on car insurance premiums.

Ask for Discounts

The majority of car insurance companies offer discounts for drivers. A few examples of car insurance discounts include low mileage discounts, good student discounts, and profession-based discounts. Some insurance companies also offer drivers a discount if they bundle their car insurance with home or life insurance, or by enrolling in a defensive driving course. Be sure to check your insurance provider’s website to see what discounts may apply to you, or have your insurance agent look over your discount options.

Review Your Coverage

If your vehicle’s insurance coverage is too much for your needs, it may be time to lose some of that coverage. Extra bells and whistles, like roadside assistance and rental car reimbursement, will cost you extra, which can add up over time. It's also wise to research the value of your vehicle to see which coverage options are best. If your vehicle is worth less than your deductible and what you pay for coverage annually, it may be wise to drop collision and comprehensive insurance. Similarly, if your vehicle’s annual premium is more than what your insurance company will pay if your vehicle is totaled, it may be a good time to switch to liability-only insurance. Pay-per-mile insurance is also an option for those who don’t drive their vehicle a lot.

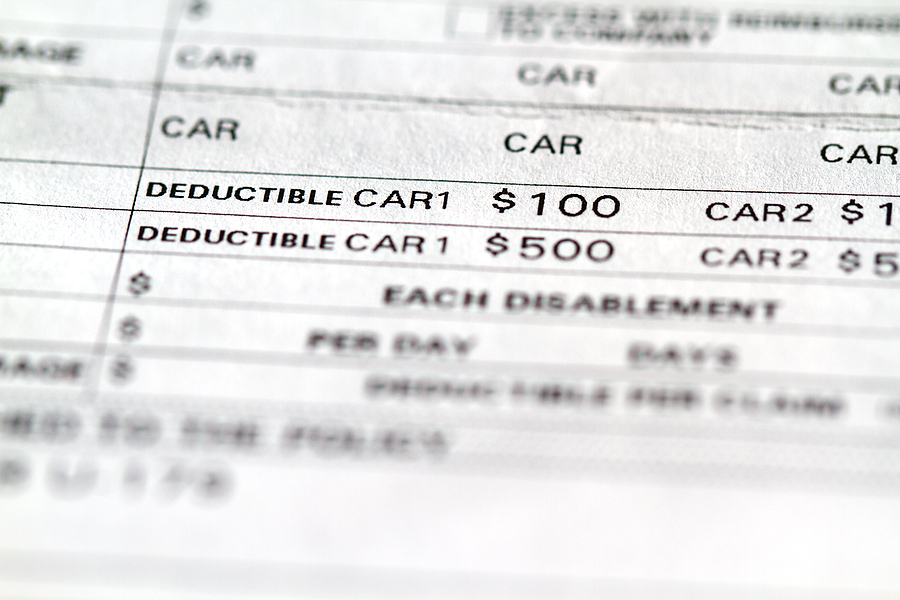

Increase Your Deductible

Your deductible is the amount you pay for damages and losses before your insurance coverage kicks in. For example, if your deductible is $500, you’ll only pay $500 for damages and losses - the rest is covered by your insurance company. In many cases, increasing your insurance deductible could mean lower monthly premiums. Even so, it’s important to avoid choosing a deductible that makes it difficult to pay for damages if you have to file a claim.

Drive a Cheaper Vehicle

Generally, the more snazzy a vehicle is, the more it’ll cost to insure. If you’re in the market for a new vehicle, it's wise to compare insurance premium rates between vehicles. A good rule of thumb to keep in mind is that safe and fairly priced vehicles are less expensive to insure. Even so, insurance costs also depend on the driver. If you’re an aggressive or careless driver, you’ll likely pay more on your insurance premiums. That said, being a conscientious driver will not only keep you safe on the road, it’ll help you save on your insurance premiums.

Strengthen Your Credit

In most states, insurance companies are allowed to view your credit score to determine what they’ll charge monthly. That said, improving your credit is an excellent way to lower your insurance premiums (in addition to many other benefits). You can improve your credit in several ways, like by making payments on time or by paying off your credit card balances. Although improving your credit score may take time, the effort can go a long way.

Shop Around

If you feel you’re paying too much for car insurance, it may be the insurance company you’re with. Insurance companies have their own ways of calculating the cost of monthly premiums, meaning some charge more or less for the same coverage. The best way to compare the price of insurance premiums is by obtaining quotes from insurance providers, either online or over the phone. You can also use online price comparison tools on Nerdwallet.com, insurance.com, and other websites.

Every motorist needs car insurance, but not everyone can afford it. That said, there are ways to save on insurance premiums without jumping through too many hoops. You may be surprised by the potential savings you find!

Hunter Morrison

About Hunter Morrison

Hunter has freelanced for various print and radio publications across Northwest Florida, including The Bay Beacon, Navarre Press, Inweekly, Crestview News Bulletin, and WUWF. He was also the Editor in Chief of the University of West Florida’s student newspaper, The Voyager. In 2023, Hunter moved to Kenai, Alaska to take up a news reporting position with KDLL Public Radio. For fun, Hunter enjoys cross-country skiing, hiking, photography, thrifting, traveling, and looking for the best Thai food around.