Refinancing Your Loan Can Save You Money

If you are paying off a car, or another significant loan, you may have heard talk of refinancing your loan to save money. There can be a lot of benefits to seeking a new loan deal! With inflation on the rise and concern about a potential recession, every extra dollar can make a difference.

“The best time to refinance a car is within the first six months of ownership,” said Gulf Winds Member Advocate Expert Debra Story. “The first thing you’re going to want to look at is the interest rate. Make sure that the interest rate is lower than your original loan for the ideal money-saving benefit.”

Here are some other ways refinancing can save you money. But, before we look at why you might consider refinancing, let’s define what refinancing is.

What is refinancing?

Refinancing is replacing your current loan with a new one. When you refinance, you are starting a new loan and with that new loan could come a different interest rate, loan longevity and monthly payments.

Why refi?

The key to saving money with a refi is knowing if you can do one of the following three things with your prospective new loan:

-

Lower your interest rate

If you can lower your interest rate, refinancing could save you money both monthly and in the long term. Even a small change in your interest rate can save you a lot of money. For example, a $10K loan at 6.5% interest and term of 4 years would cost you $2,960 in total interest while the same $10K loan at 3.5% would be only $1,500 in interest. So the total interest saved would be 3% which saves you $1,460!

- Change your term

If you're feeling stretched with your current monthly payments, refinancing can give you the opportunity to lengthen your repayment time and lower your monthly payment.

-

Cash out

If money is tight and you need a little extra cash from the equity in your car, you might be able to refinance your loan with a longer term and/or a lower interest rate and pocket the difference on your current loan.

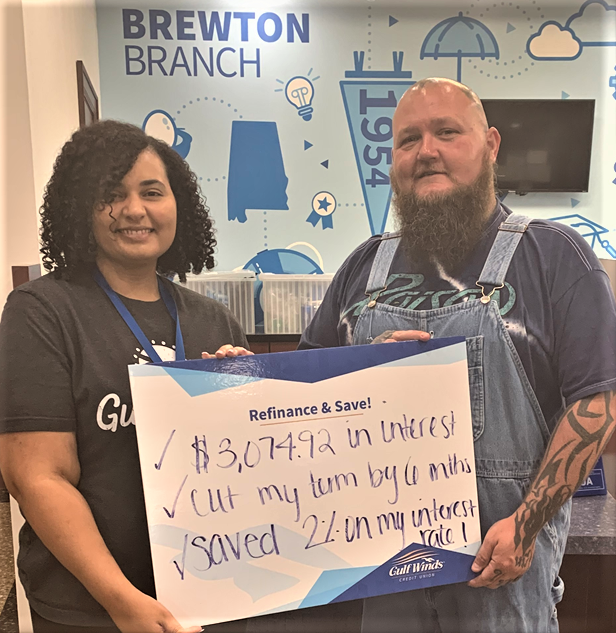

The Gulf Winds team is always looking to help people save money on their loans. Our member James saved over $3,000 through a refinance.

Potential pitfalls to avoid

Another thing to consider before you refinance is how close you are to paying off your loan. If you are almost paid in full, it may not be worth it to start a new loan. There are online loan calculators that can help you determine if your new interest rate will save you money considering the term of your new loan.

Be careful when shopping for refinance loans, as many creditors will do what is called a hard inquiry into your credit, which could lower your credit score a few points for up to a year. Make sure your credit score can take a slight dip while you go through the refinancing process. Just know this is temporary and your credit score will return to normal if you continue upholding good credit practices.

Gulf Winds offers a simple tool that will get you prequalified for a loan so you can see how much you can save. Check it out for your auto and personal loans. Best part, there’s no impact on your credit score. The Gulf Winds team is happy to walk you through a potential refinance and help you decide if this is the best path for you.

Savannah Vasquez

Savannah Vasquez is a local writer and photographer. She has written for local newspapers, tourism websites and colleges over the past seven years. When not working, you will find Savannah paddleboarding and spending time with her husband and two young sons.