Financial Tips for College Students

Attending college can be an expensive experience. With the high cost of tuition often coupled with moving out of a parent’s home, being financially stable during this time in one’s life can be a difficult task. Even so, there are several ways you can improve your financial literacy in college while saving money. Below are some college money-saving tips to keep in mind.

Budget

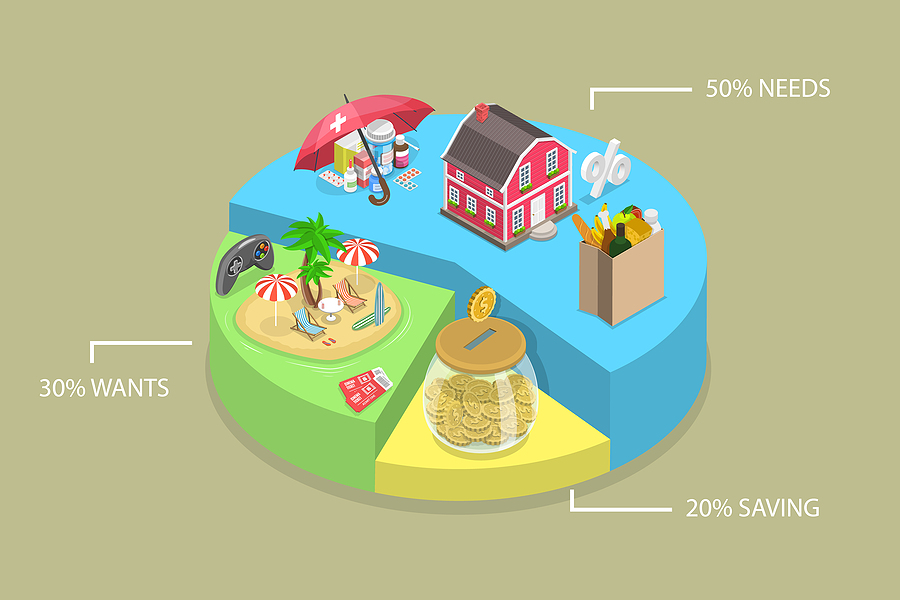

One of the primary keys to financial success is budgeting. Many college students have never created a budget before, so it’s important to keep all potential costs in mind. Rent, groceries, utility bills, and other miscellaneous expenses are crucial to consider, and you should make adjustments to your budget as you see fit. A popular budget model to follow is the 50-30-20 rule, where 50% of your expenses go toward needs, 30% go toward wants, and 20% go to savings. For students whose primary income is a grant or student loan paid in a lump sum each semester, plan your expenses ahead of time. It’s also wise to place this money in a savings account. Gulf Winds has a variety of savings account options to choose from.

Build Credit

Building credit in college is important because it could lead to improved financial well-being after graduation. That said, it’s a good idea to start with one or two credit cards with a low credit limit but use them wisely. Going outside your credit limit could cause you to fall into debt, setting you back financially. It can also decrease your credit score, so be sure to keep tabs on your spending. Gulf Winds offers several credit card options, all of which have no annual fees. To learn more about credit scores, check out our page on the topic.

Buy used

When in college, almost everything can seem expensive. An easy way to offset potential costs is to purchase used goods. Clothes and appliances, for example, can be found at most second-hand stores for a fraction of what they’d cost new. You can also purchase materials for college, like school supplies and textbooks, from used bookstores. If you have a friend or peer who has completed a course you’re enrolled in, ask them if you can purchase their textbooks from them. Renting textbooks is another option.

Look for Student Discounts and Freebies

Many businesses, from retail stores to movie theaters, offer student discounts. It never hurts to ask a business about student discount offerings before making a purchase, just ensure your student ID card is handy. If you're looking to get around without spending money on gas, some cities offer discounted public transit fares for students. Many colleges also have a bike loan program. When it comes to food-related expenses, an easy way to save on groceries is by enrolling in a meal plan at your college’s cafeteria. You can also save money on entertainment by participating in free campus activities.

Get a Job

Although some may say that college is like a full-time career, working some sort of job while in school is crucial to earning a form of income. There are lots of jobs available to college students, from part-time gigs to campus jobs. Depending on your area of study, there may also be entry-level jobs available in your prospective field, including freelance gigs and paid internships. For those with busy schedules who want to make money on their own time, consider pursuing a side hustle! There are lots of side hustles out there, and our blog on the topic details some of these.

Smart financial decisions during your college years will lead to improved financial well-being in the post-collegiate world. Since money is often tight for college students, it's essential to spend what money you have wisely. For more information on financial literacy, be sure to read our blog highlighting financial literacy tips and tricks.

Hunter Morrison

About Hunter Morrison

Hunter has freelanced for various print and radio publications across Northwest Florida, including The Bay Beacon, Navarre Press, Inweekly, Crestview News Bulletin, and WUWF. He was also the Editor in Chief of the University of West Florida’s student newspaper, The Voyager. In 2023, Hunter moved to Kenai, Alaska to take up a news reporting position with KDLL Public Radio. For fun, Hunter enjoys cross-country skiing, hiking, photography, thrifting, traveling, and looking for the best Thai food around.